|

My former colleagues at McKinsey have just published an article on stress-testing for nonfinancial companies. Unsurprisingly, I very much agree with them. Whether the goal is stress-testing (a specific risk-management centred viewpoint) or strategic planning, companies need to think more in scenarios to effectively get their arms around the uncertainty they need to navigate.

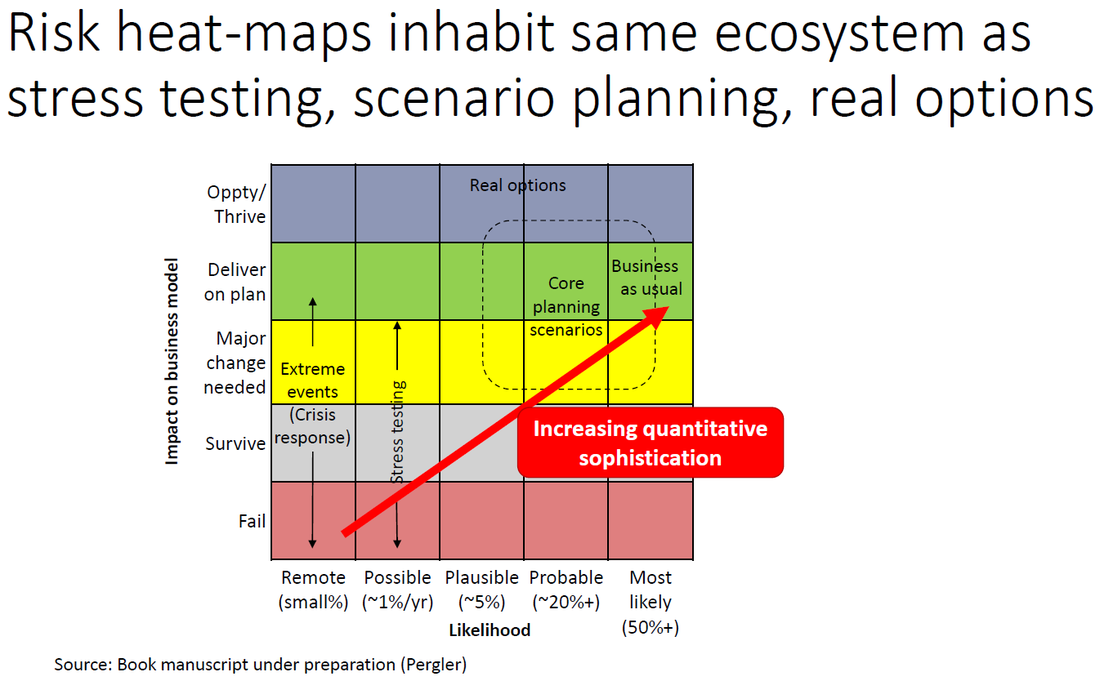

I've written about this on these blog pages and in an article planned for a Canadian mainline business publication (where it ultimately ended up on the cutting room floor after internal conflict in the editorial board in which I was collateral damage) in the context of the election of Mr Trump as president. Ultimately, stress testing, scenario planning, and risk management live in the same ecosystem, just in different ecological niches. Ideally they work together, and which one is a priority to exercise for a given company, or provides the best path towards a more holistic approach, depends on the circumstances. I'm a member of Umbrex, a network of independent consultants with a background in the top strategic consulting firms. While there are a number of companies out there that uberize the consulting model (i.e., do the client development front-end, the billing/support back-end, and subcontract independent consultants to do the actual work), Umbrex is more of a consultants' pub, or actually members-only club. We may form joint teams when an opportunity warrants, but above all, we exchange ideas, and refer our colleagues to trusted experts or service providers when needed. From a client service perspective, it erodes one of the biggest structural advantages of work in a large consulting firm: the ability to quickly find Someone who knows about the Widget market in Micronesia when that's what unexpectedly bubbled up in the project.

We also support and challenge each other on the big picture as well as the nuts and bolts of running an independent consulting practice. A lot of this is on a private mailing list, but the founder of Umbrex, Will Bachman, recently launched a publicly-accessible podcast, and this week I'm his guest, talking both about what I do and how I work. For anyone else consulting independently, or interested in what it's like, Will's interview with me is #19 of a growing library of episodes, all of which can be listened to not only on the website but as a regular podcast through itunes or other channels. Belief is stronger than analysis. This is well-known to those who study cognitive biases (Kahneman, Slovic, Ariely, etc.) but interesting to see it confirmed with an experiment involving politics and math: moderately challenging calculations more likely to be "done wrong" if the results go against the subject's political beliefs than if the results are politically neutral. And the more "numerate" the subject, the stronger the effect.

I think this is an important part of the answer for those of us who look at the political situation (anywhere...) and are amazed how "sane" people robustly maintain their belief system impervious to "evidence", and the importance of patently flimsy echo-chamber talking points to anchor those beliefs. The underlying research is at http://static1.1.sqspcdn.com/…/138…/wp_draft_1.5_9_14_13.pdf The math task was Bayesian inversion of a contingency table, something humans are bad at (e.g. health treatments). I'm not 100% convinced the hypothesis "people do math wrong" (a quality observation about Kahneman's thinking-slow system) is proven versus an alternative hypothesis of "people don't bother to engage thinking-slow if political beliefs provide a salient thinking-fast answer". |

Martin PerglerPrincipal, Balanced Risk Strategies, Ltd.. Archives

February 2023

Categories |

Copyright © 2014-2020, Balanced Risk Strategies, Ltd. – Contact us

RSS Feed

RSS Feed